Популярные статьи

- Государственно-частное партнерство: теория и практика

- Международный форум по Партнерству Северного измерения в сфере культуры

- Мировой финансовый кризис и его влияние на Россию

- Совершенствование оценки эффективности инвестиций

- Теория экономических механизмов

- Кластерный подход в стратегии инновационного развития зарубежных стран

- Качество и уровень жизни населения

- Фактор времени при оценке эффективности инвестиционных проектов

- Государственная собственность в российской экономике - Масштаб и распределение по секторам

- Вопросы оценки видов социального эффекта при реализации инвестиционных проектов

- Особенности нового этапа инновационного развития России

- Перспективы социально-экономического развития России

- Экономический кризис в России: экспертный взгляд

- Налоговые риски

Популярные курсовые

- Учет нематериальных активов

- Потребительское кредитование

- Бухгалтерский учет - Курсовые работы

- Финансы, бухгалтерия, аудит - курсовые и дипломные работы

- Денежная система и денежный рынок

- Долгосрочное планирование на предприятии

- Диагностика кризисного состояния предприятия

- Интеграционные процессы в современном мире

- Доходы организации: их виды и классификация

- Кредитная система: место и роль в ней ЦБ и коммерческих банков

- Международные рынки капиталов

- Многофакторный анализ производительности труда

- Непрерывный трудовой стаж

- Виды и формы собственности и трансформация отношений собственности в России

- Анализ финансово-хозяйственной деятельности

Навигация по сайту

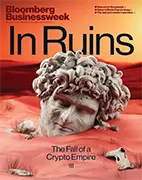

Bloomberg Businessweek (November 21, 2022) |

| Скачать - Журналы | |||

|

Год выпуска: November 21, 2022 Автор: Bloomberg Businessweek Europe Жанр: Бизнес Издательство: «Bloomberg Businessweek Europe» Формат: PDF (журнал на английском языке) Количество страниц: 64 Sam Bankman-Fried’s crypto exchange can’t pay its users. Where did the money go? The epic unraveling of cryptocurrency exchange FTX.com has delivered many shocks: The $8 billion in liabilities it couldn’t pay, its huge exposure to its own magic-bean digital tokens, the apparent misuse of customer funds and the mysterious unauthorized withdrawal that drained off a chunk of the money that remained. Even so, it could have been a lot worse: Founder Sam Bankman-Fried had been trying to expand beyond crypto enthusiasts to capture the assets of everyday savers and investors in stocks and funds. The music stopped before he could get there.

The Last Petrostate's Big Gamble

From Tech Temple to Car Lot

Ukraine’s Unlikely Heroes

IN BRIEF

OPINION

AGENDA

REMARKS

BUSINESS

TECHNOLOGY

FINANCE

ECONOMICS

SOLUTIONS

PURSUITS

LAST THING

скачать журнал: Bloomberg Businessweek (November 21, 2022)

|

Новые книги и журналы

Популярные книги и учебники

- Экономикс - Макконнелл К.Р., Брю С.Л. - Учебник

- Бухгалтерский учет - Кондраков Н.П. - Учебник

- Капитал - Карл Маркс

- Курс микроэкономики - Нуреев Р. М. - Учебник

- Макроэкономика - Агапова Т.А. - Учебник

- Экономика предприятия - Горфинкель В.Я. - Учебник

- Финансовый менеджмент: теория и практика - Ковалев В.В. - Учебник

- Комплексный экономический анализ хозяйственной деятельности - Алексеева А.И. - Учебник

- Теория анализа хозяйственной деятельности - Савицкая Г.В. - Учебник

- Деньги, кредит, банки - Лаврушин О.И. - Экспресс-курс

Популярные рефераты

- Коллективизация в СССР: причины, методы проведения, итоги

- Макроэкономическая политика: основные модели

- Краткосрочная финансовая политика предприятия

- История развития кредитной системы в России

- Марксизм как научная теория. Условия возникновения марксизма. К. Маркс о судьбах капитализма

- Коммерческие банки и их функции

- Лизинг

- Малые предприятия

- Классификация счетов по экономическому содержанию

- Кризис отечественной экономики

- История развития банковской системы в России

- Маржинализм и теория предельной полезности

- Иностранные инвестиции

- Безработица в России

- Кризис финансовой системы стран Азии и его влияние на Россию

- Источники формирования оборотных средств в условиях рынка

Популярные лекции

- Шпаргалки по бухгалтерскому учету

- Шпаргалки по экономике предприятия

- Аудиолекции по экономике

- Шпаргалки по финансовому менеджменту

- Шпаргалки по мировой экономике

- Шпаргалки по аудиту

- Микроэкономика - Лекции - Тигова Т. Н.

- Шпаргалки: Финансы. Деньги. Кредит

- Шпаргалки по финансам

- Шпаргалки по анализу финансовой отчетности

- Шпаргалки по финансам и кредиту

- Шпаргалки по ценообразованию